State tourism tax collections on record pace; three counties in Northeast Arkansas experience significant growth

by November 17, 2016 6:59 am 294 views

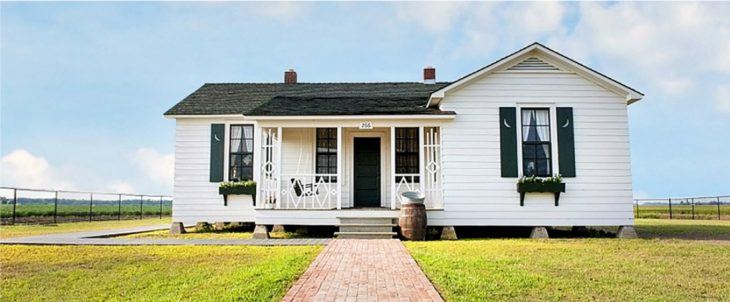

The restored Cash home in the Dyess Colony.

When Ammi Tucker moved to Mississippi County almost 10 years ago tourism played an insignificant role in the local economy, and the same was true in many other Northeast Arkansas counties east of the Ozark Mountains.

The flat row crop fields don’t offer the outdoor recreational opportunities available in other parts of the state, but a rich musical heritage may raise the Mississippi Delta’s economic fortunes.

Mississippi County collected $251,898 in state tourism sales tax from January to August, a 21% increase from the same period in 2015, according to the state. Tucker, the director of the Osceola/Mississippi County Chamber of Commerce, thinks the newly renovated Johnny Cash homestead in Dyess is the primary reason why the numbers have surged.

“We get people from all over the country and all over the world visiting Mississippi County,” she told Talk Business & Politics. “People, especially Baby-Boomers, love music history and we have a lot to offer.”

Arkansas State University started the $3.5 million restoration of the music legend’s home in 2011.

Arkansas Parks and Tourism Executive Director Kane Webb told Talk Business & Politics the state’s musical heritage is becoming a major factor in tourism, the fastest growing sector in the state’s economy he said. The Dyess Colony, the place where Cash grew up, may become a mainstay attraction in the Natural State, he said.

“We really think it could become an international destination,” Webb said.

Arkansas’ 2% tourism tax generated $10.495 million in January-August 2016, up 3.12% over the $10.177 million in the same period in 2015.

Tourism tax collections set a torrid pace through the first eight months of the year, and that was coming off a record year in 2015. Collections of Arkansas’ 2% tourism tax in 2015 topped $14.815 million, up 8.31% compared to $13.677 million in 2014. The record collections marked the first time the tax topped $14 million and marked the fifth consecutive year of year-to-year gains of the tax.

Crittenden County may also reap a financial windfall from the Cash home in Dyess and other Rock-n-Roll related tourism far beyond the county’s borders, West Memphis tourism and business developer Jim Jackson told Talk Business & Politics. The county has collected $250,226 in tourism sales tax receipts through August, an 11.44% uptick from the previous year.

Graceland, the home of music legend Elvis Presley, draws millions of visitors each year, and many of them are venturing into eastern Arkansas to visit places like the Dyess Colony, the Guitar Walk in Walnut Ridge and other places where early rock-n-rollers performed in the 1950s, he said. More than 700 visitors trek to Dyess each month, and many come through West Memphis.

“There’s an effect, there’s no doubt about it. We see it in the numbers,” Jackson said. “There’s been a bump. It’s undeniable.”

The financial surge goes beyond tourism tax collections. West Memphis has collected $1.136 million in A&P taxes through September, a 4.3% increase from 2015. When these tourists come through town many are stopping to eat, shop, buy gas, or rent a hotel room, he said.

An improved economy in recent years has attracted tourists to Crittenden County tourism staples such as Southland Park Gaming and Racing and Riverside International Speedway, one of the top automobile racing venues in the Mississippi Delta Region, Jackson said. The Tunica Casinos have experienced revenue drops in recent years, and Southland may have picked off a few Memphis tourists who find it easier to navigate to West Memphis than to Tunica, he said.

The tourism dollars in Crittenden County may accelerate even further. In October, a bike and walk path on the Union Pacific bridge, the Big River Crossing, opened to the public. The 10-mile path connects West Memphis with downtown Memphis. Bike excursions have grown in popularity in the area in recent years, and this will bring another influx of visitors into the city each day, Jackson said.

“Who would have ever though bicycling would become popular in eastern Arkansas?” Jackson said rhetorically.

In Craighead County, tourism tax collections totaled $248,350 through the end of August, a 5.27% spike from the previous year. Jonesboro’s hospitality taxes rose to $446,711 during the same timeframe, an 8.84% increase as compared to 2015. Rain or the lack thereof, may be the culprit.

Jonesboro hosts more than 30 youth baseball and softball tournaments in the spring and early summer, according to the city. These tournaments can draw as many as 40,000 people to the city during these months, Parks and Recreation assistant director Danny Kapales told Talk Business & Politics.

This spring and summer were unusually dry during the tournament season, meaning virtually none were rained out, Kapales said. The city has promoted these tournaments for the last several years and they continue to grow in popularity, he said.

“You can talk to any hotel owner in Jonesboro … on weekends when we have tournaments, they’re packed. On weekends when there are no tournaments or we have a rainout, they’re empty.”

Jonesboro Regional of Commerce vice-president Cari White told Talk Business & Politics the chamber agrees with the Kapales. There are 10-15 players per team, and each player usually brings at least two relatives or friends to watch them play. A player’s family will spend, on average, $440 during a tournament weekend on lodging, food, and other expenses, White said.

Tourist dollars like those turn over up to seven times in the local economy, she said.

Mississippi County may now be known as the birthplace of Johnny Cash, but there are other tourist draws in the county, Tucker said. Wilson, one of the most important towns in the county’s history, has been rehabilitated and is set to become an art, culture, and sustainable living Mecca in the Delta. The Delta Lights also attracts thousands of visitors during the holidays, and it seems to grow each year, she said.

“I think we’re doing a good job of promoting what we have to offer,” she said.

Following are the top 10 counties in terms of collecting 2% tourism tax in the January-August period, and the percentage increase/decrease from the same period in 2015.

Pulaski: $2.31 million, up 4.56%

Benton: $1.249 million, up 6.79%

Garland: $1.049 million, up 2.25%

Washington: $888,926, up 14.73%

Carroll: $476,837, up 3.74%

Sebastian: $398,714, up 4.86%

Baxter: $273,354 up 7.5%

Mississippi: $251,898, up 20.8%

Crittenden: $250,226, up 11.44%

Craighead: $248,350, up 5.27%