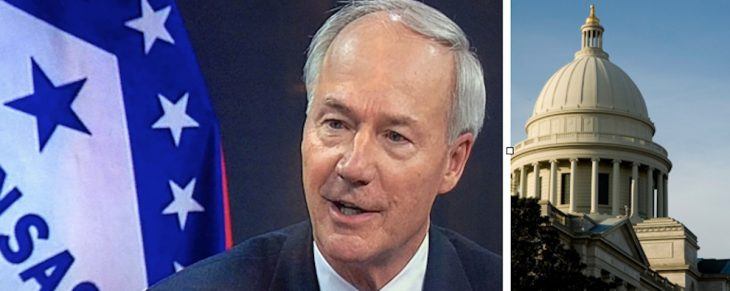

Gov. Hutchinson lays out $5.5 billion budget for 2017 legislative session, asks for $50 million tax cut (Updated)

by November 9, 2016 11:03 am 427 views

Gov. Asa Hutchinson on Wednesday (Nov. 9) told Arkansas lawmakers he plans to introduce a $50 million tax cut in the upcoming 90th General Assembly that begins in January, and he proposed a balanced budget of nearly $5.5 billion for the biennium.

Although the governor spoke to lawmaker’s in broad terms about his conservative budgeting approach for the 2017 legislative session, his specific proposal for fiscal year 2018 was presented by Arkansas Department of Finance and Administration Director Larry Walther and staff at the Joint Budget Hearings held at the State Capitol.

According to budget details provided by DFA officials, the executive recommendation calls for an upward revision of 2.9% when compared to fiscal 2017 forecast, which would bring in an expected $153.5 million in additional funding for the current year.

It calls for a 2.8% increase in general revenues in fiscal year 2018, up $149.1 million, and a 4.9% increase in fiscal year 2019, up $266 million. General revenues are primarily driven by individual and corporate income tax collections, sales taxes and other tax collections by the state.

The governor’s plan also calls for a more robust 4.4% increase in general revenues in fiscal year 2019 of $5.7 billion, up $964.6 million from fiscal year 2018. General revenues are primarily driven by individual and corporate income tax collections, sales taxes and other tax collections by the state.

“(This) budget is designed for restraint and responsibility in government spending. We control spending in order to balance the budget and to safeguard against overspending in uncertain economic times,” Hutchinson said. ”So to accomplish these goals, tough choices are required of the budget. It does not take a PHd in economics to know we can’t say ‘yes’ to every spending need. And we also should not say ‘yes’ to every tax cut.”

Hutchinson also spoke in detail about what he called a historic election night for the Republican Party and nation, which saw the American voters elect GOP candidate and New York real estate mogul Donald Trump as the nation’s 45th president.

UPDATED INFO: In his 10-minute speech to lawmakers, Hutchinson told lawmakers that together they would map out priorities and measure results for the budget. He spelled out hikes in funding for education facilities, foster care and prison reform that will be partially financed through government efficiencies and consolidation.

Besides the $50 million tax cut, the proposal that received the most outward response from lawmakers was the governor’s plan to cut set asides for so-called General Improvement Funds, or GIFs for both the executive and legislative branch.

“As you can see …, this budget meets the needs of our state, maximizes opportunities for economic growth, and continues to emphasize efficiencies, reform and savings. I look forward to working with the General Assembly as we serve the people of Arkansas together,” the governor told lawmakers.

After Hutchinson left the morning budget hearing, Walther and the governor’s budget director, Duncan Baird, provided lawmakers with a line-by-line review of the Hutchinson’s fiscal biennial plan, offering numerous times to answer specific questions about the voluminous budget outline.

Following the meeting, several lawmakers said they still had questions about the governor’s fiscal plan and tax cuts and offered mixed sentiments and concerns about recent revenue reports and projections on state surplus funds and tax collections.

Sen. Bruce Maloch, D-Magnolia, chair of the Joint Committee on Economic and Tax Policy, said he needed to digest more details of the governor’s plan and would for now take a wait-and-see attitude before coming to any conclusions.

“Looking at our revenue year-to-date, we are still down some and (consumer) spending has been weak,” Maloch said. “Before I make a commitment to any kind of tax reduction, I want to first of all look what happens over the next two to three months to revenue coming in, and then also look at other needs and priorities in the state.”

Maloch and others also said there are still questions about highway funding and what may happen with President-elect Donald Trump and Medicaid funding that comes to the state.

“There’s just a lot of unknowns out there for me,” said the conservative Democrat. “I appreciate (Hutchinson’s) presentation today, but it may take a little time before I decide what we all plan to do.”

Rep. Charlie Collins, R-Fayetteville, said the governor’s proposal will likely be contentious in the upcoming session.

“A number of us feel like we can’t afford tax cuts, or maybe we can’t afford them now,” Collins said after the budget hearings.

Like Maloch, the Northwest Arkansas lawmaker said state revenue collections may not be as strong as they need to be for another tax cut. In his first official act as governor in 2015, Hutchinson was able to enact a $102 million tax cut that lowered the state’s middle income tax bracket from 6% to 5%.

“We’ve got to be very responsible with making those (tax cuts) because none of us wants to be up here passing an income tax cut to fix the unintended consequences we just made,” said Collins, chair of the House Insurance and Commerce committee.

Hutchinson said he plans to offer additional details on his tax cut plans ahead of the legislative session.