The Compass Report: Job gains, sales tax growth story of the second quarter

by October 10, 2016 6:08 am 595 views

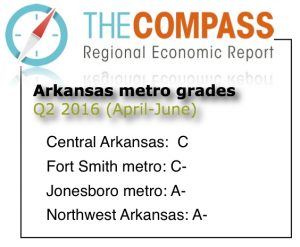

The second quarter economic story of Arkansas’ four key metro areas was much like the first quarter story: unchanged from the previous quarter, but healthy, with continued job gains and sales tax revenue growth, according to The Compass Report.

Compared to the second quarter of 2015, economic conditions were down slightly in Central Arkansas, better in Northwest Arkansas, unchanged in the Fort Smith metro, and up in the Jonesboro metro.

The quarterly Compass Report is managed by Talk Business & Politics, and is sponsored by Lowell-based Zero Mountain Logistics, a subsidiary of Fort Smith-based Zero Mountain Inc. The report is the only independent analysis of economic conditions in four Arkansas metro areas – Central Arkansas, Northwest Arkansas, Fort Smith metro, and the Jonesboro metro.

To underscore the impact of the four metro areas, for June the unemployment rate for the rest of the state was 4.5%. The statewide unemployment rate with the four largest metros added back in was 4.2%. The gap had been much greater but much of the state, at least in terms of unemployment rate, has improved. For example, the Pine Bluff Metro area unemployment rate (typically the highest in the state) was 5.8% in June.

Nonfarm jobs in central Arkansas grew by 2.3% between June 2016 and June 2015, was up 3.7% in Northwest Arkansas, up 0.5% in the Fort Smith metro, and rose 3.3% in the Jonesboro metro. The labor force grew June-on-June in Northwest Arkansas by roughly 3.9%, was up 2.7% in central Arkansas, up 0.5% in the Fort Smith area and up 2.7% in the Jonesboro metro.

Jeff Collins, the economist for Talk Business & Politics who gathers data used in The Compass Report, said the booming Northwest Arkansas economy continues to lead overall economic growth in the state.

“The unemployment rate in Northwest Arkansas was the lowest in the state amongst all MSAs in June (3.1%). It was 0.6% lower than that for the Little Rock/North Little Rock/Conway MSA (3.7%),” Collins noted. “The highest rate in the state was the Pine Bluff MSA at 5.8%. To add perspective, of the 387 MSAs in the country, only 6 posted rates above 10% while 8 had rates below 3%.”

“The unemployment rate in Northwest Arkansas was the lowest in the state amongst all MSAs in June (3.1%). It was 0.6% lower than that for the Little Rock/North Little Rock/Conway MSA (3.7%),” Collins noted. “The highest rate in the state was the Pine Bluff MSA at 5.8%. To add perspective, of the 387 MSAs in the country, only 6 posted rates above 10% while 8 had rates below 3%.”

Collins’ analysis also showed that the Northwest Arkansas regional economy had sales and use tax collections totaling roughly $23.4 million in the second quarter while the larger central Arkansas regional economy had collections for the same period of roughly $20.3 million.

Nationally, Collins said economic health still rests with the consumer.

“The consumer is king, at least until the uncertainty created by the election cycle is over. Consumer confidence has improved significantly but any number of national or international factors could create uncertainty and reduce consumer confidence. This is particularly true to the extent that international events impact the equity markets,” Collins said.

FORT SMITH REGION

The Compass Report for the Fort Smith area posted a C- grade for the second quarter, down from the C in the first quarter of 2016 but unchanged compared to the same quarter of 2015.

The story for the metro area continues to be slow to muted job growth. The number of jobs totaled 114,000 in June, just 0.52% more than the 113,400 in June 2015. Sales tax revenue growth is one of the few positives for the region.

The June total number of employed in the MSA was an estimated 116,729. By contrast, total employment in June 2006, prior to the recession, was 125,426.

The June total number of employed in the MSA was an estimated 116,729. By contrast, total employment in June 2006, prior to the recession, was 125,426.

“This is testament to the impact of the recession on the Fort Smith regional economy as well the ongoing loss of manufacturing,” Collins wrote.

But there is good news – relatively speaking – on the manufacturing front, with the number of manufacturing jobs basically stable since February 2015.

“This is a positive sign for the metro given the long-term trend,” Collins said.

However, the Fort Smith economy continues to lag the other three metro areas in terms of overall growth.

“Data for the Fort Smith regional economy is mixed. On the one-hand, the declining unemployment rate and stabilized manufacturing sector bode well for future performance. However, a reliance on growth in the government sector to lead employment growth is not sustainable,” Collins wrote.

NORTHWEST ARKANSAS

The Northwest Arkansas area posted an A- grade for the second quarter, unchanged compared to the first quarter and above the B+ for the second quarter of 2015.

Job growth (243,400 non-farm jobs in June 2016 compared to 234,700 in June 2015) continues to push the region forward, to include significant gains in building permit values and construction employment. The booming regional tourism industry continues to set record employment levels.

As it was in the first quarter, building activity remains robust in Northwest Arkansas.

“Improved construction activity has translated into improved employment in the sector. Since the height of the recession when sector employment fell to just over 7,000 jobs, the sector has grown by approximately 44%. June-on-June sector employment was up 8.3% driven by strong permit activity and trend growth. Based on permit data the sector employment is likely to grow in the coming quarters,” Collins noted in his analysis.

Growth in business and professional services was exceptionally strong growing at 8.5% June-on-June.

“Strong growth is expected in employment, construction and tax collections for the foreseeable future,” Collins noted.

CENTRAL ARKANSAS

For the second quarter of 2016, the state’s largest metro area posted a C, just below the C+ in the first quarter, and below the C+ in the second quarter of 2015.

Job gains, a falling unemployment rate and tourism sector growth helped the region’s economy. Putting downward pressure on the second quarter grade was a slight decline in building permit values and sales tax revenue.

Collins said the central Arkansas jobs picture continues to improve.

“The unemployment rate was an estimated 3.7% in June. The rate indicates solid employment growth and a return to trend. Comparing to June of last year, the metro area unemployment rate has fallen 1.1%,” Collins wrote. “Of all the economic indicators, unemployment rates at or near the full employment rate of 4% stand out. Growth has been solid in the state’s largest metro.”

JONESBORO METRO

The Jonesboro metro began its first quarter in The Compass Report with a B+.

The region posted a second quarter grade of A-, up from the B+ in the first quarter. Nonfarm employment continued to expand in the second quarter, with a 3.33% increase in jobs between June 2015 and June 2016.

Sales tax revenue and building permit values also grew for the region in the second quarter, with sales tax revenue in Craighead and Poinsett counties up 4.3% in June compared to June 2015.

Collins said the jobs and sales tax data for the Northeast Arkansas area continue to impress. Sales and use tax collection data indicate that Jonesboro metro area experienced solid growth quarter-on-quarter. In percentage terms, growth in collections was 6.9%. Total collections were roughly $5.4 million for the quarter.

“The unemployment rate in the Jonesboro metro was a solid 3.5% in March. This is below the full employment rate of 4% and 1.7% below the rate in March 2015. Employment conditions in the metro are very good relative to the state and most other metro areas. The employment data are particularly encouraging given the erosion of manufacturing employment prevalent across many metros,” Collins noted.

DATA AND REPORT DOCUMENTS

Link here for the raw data used to prepare The Compass Report for the four metro areas.

Link here for more narrative about regional and national economic conditions.

UNDERSTANDING THE COMPASS REPORT GRADES

A key factor in understanding The Compass is in understanding the “grading” approach used to measure the current and leading economic indicators.

The strategy is to place the most recent data in historical context. Average values for the percent change over the referenced time period were calculated, as were standard deviations for each measure.

The more similar current values are to historic averages the more likely the indicator grade is to be a “C.”

The farther away the observed value, as measured by the standard deviation of the data, the more divergent the grade from “C.” In other words, “C” reflects no change in economic activity. The grades “B” or “A” indicate improvement above the historical average, and “D” and “F” indicate a decline in economic activity compared to the historical average.

REGIONAL GRADE HISTORY

FORT SMITH REGION – Fort Smith regional economy

2Q 2016: C-

1Q 2016: C

4Q 2015: C

3Q 2015: C-

2Q 2015: C-

1Q 2015: B

4Q 2014: C+

3Q 2014: C+

2Q 2014: C

1Q 2014: C

4Q 2013: C+

3Q 2013: C+

2Q 2013: C

1Q 2013: C-

4Q 2012: C

3Q 2012: C-

2Q 2012: C-

1Q 2012: C-

4Q 2011: C-

3Q 2011: C

2Q 2011: C

1Q 2011: C-

4Q 2010: C-/D+

3Q 2010: C-

2Q 2010: C-

1Q 2010: C-

4Q 2009: D

3Q 2009: D

2Q 2009: D-

1Q 2009: D+

NORTHWEST ARKANSAS – Northwest Arkansas regional economy

2Q 2016: A-

1Q 2016: A-

4Q 2015: A

3Q 2015: B+

2Q 2015: B+

1Q 2015: B

4Q 2014: B

3Q 2014: B+

2Q 2014: B

1Q 2014: B-

4Q 2013: B+

3Q 2013: B+

2Q 2013: B

1Q 2013: B

4Q 2012: C

3Q 2012: B+

2Q 2012: B-

1Q 2012: B-

CENTRAL ARKANSAS – Central Arkansas regional economy

2Q 2016: C

1Q 2016: C+

4Q 2015: B-

3Q 2015: C+

2Q 2015: C+

1Q 2015: C+

4Q 2014: C+

3Q 2014: C

2Q 2014: C

1Q 2014: C-

4Q 2013: C-

3Q 2013: C-

2Q 2013: C-

1Q 2013: C-

4Q 2012: B-

3Q 2012: C-

2Q 2012: C+

1Q 2012: C-

JONESBORO METRO – Northeast Arkansas regional economy

2Q 2016: A-

1Q 2016: B+