$1.3 billion Sun Paper project construction start of early 2017 pushed back more than six months

by July 20, 2016 9:01 am 6,013 views

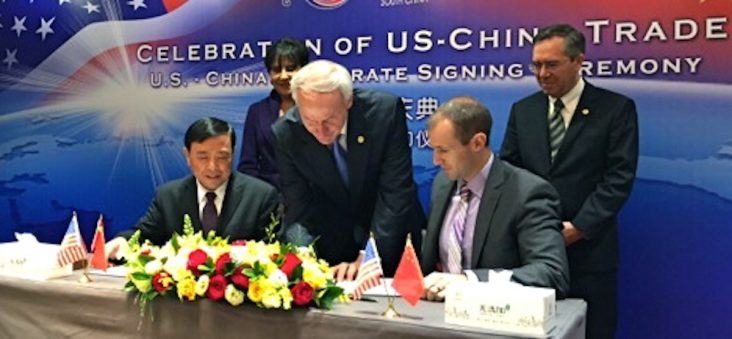

Gov. Asa Hutchinson leans in during an April 2016 meeting to sign the letter of intent with Sun Paper, a company based in China that plans to build a $1.3 billion pulp plant in south Arkansas.

A spokeswoman for Sun Paper Industry of China says the planned early 2017 construction start for the $1.3 billion superproject in Clark County will likely be pushed back to the third quarter of next year because of ongoing pre-engineering and feasibility studies for the bio-product paper mill.

“They are still trying to nail down some of the issues involving the project and it has taken more time than was expected,” said Julie Mullenix of Little Rock-based Mullenix & Associates, a local governmental relations, PR and lobbying firm.

In late April, Gov. Asa Hutchinson signed a memorandum of understanding with Sun Paper Chairman and Founder Hongxin Li to bring the Chinese conglomerate to south Arkansas to invest more than $1 billion to build a paper manufacturing facility creating 250 new jobs at an annual average salary of $52,000. At the time, Sun Paper officials said they hoped to begin construction on the project in the first quarter of 2017.

According to state economic development officials, the Sun Paper plant will be located at the Clark County Industrial Park in Gum Springs, just south of Arkadelphia on U.S. 67 and less than a mile from Interstate 30. The location of the project will be at the center of Arkansas’ so-called “wood basket,” where the state’s timberland forest covers about 18.8 million acres – about half of the state.

Arkansas Forestry Commission officials say between 2011 and 2015, Arkansas grew approximately 25 million tons of pine timber – the product Sun Paper needs. Roughly 16.1 million tons of pine timber were harvested leaving 8.9 million tons across the state. Sun Paper could use up to 4 million tons of pine timber per year, the commission said.

Mullenix, whose firm also handled negotiations on behalf of Sun Paper with state government officials in bringing the project to Arkansas, said the Chinese paper goods giant is still trying to finalize the paper goods and “product mix” that the Gum Springs mill will be able to manufacture once operational.

The local Sun Paper spokeswoman also stressed the “bio-products” nature of the South Arkansas paper manufacturing facility, meaning the mill will be able to use in production all of the region’s huge inventory of unused forest dregs, logging leftovers, imperfect commercial trees, dead wood and other non-commercial trees that need to be thinned from crowded, unhealthy, fire-prone forests.

In addition, Mullenix said Sun Paper officials will meet next week with several pre-engineering firms in Arkansas to finalize design and technical details of the project that will allow the permitting application process to begin with the state Department of Environment Quality (ADEQ).

“Once we meet with those pre-engineering firms, then will be get those (ADEQ) applications underway.” Mullenix said. “It will push the timetable back somewhat. It will be more like this third quarter now because it will take those engineering firms several months to prepare the exhaustive applications.”

PERMITTING PROCESS

Although ADEQ officials have yet to receive permit applications from Sun Paper, agency officials said it is their understanding the facility will likely need a “major source” unified air permit for construction and operation. The project will also likely need two storm water permits – one for the construction phase of the project and an operational permit once the facility is built – and a wastewater discharge permit. When ADEQ receives a permit application, staff in the regulatory area covered by the permit will conduct an initial review to determine whether the application is “administratively complete,” as defined by regulations.

If deficiencies are found, the applicant is notified and asked to submit additional information. Once the administratively complete determination is made, a legal notice announcing that finding is published. The notice also provides the opportunity for initial public comment, and to request a public hearing on the proposal. It is the ADEQ’s discretion whether to schedule such a hearing.

According to ADEQ spokeswoman Kelly Robinson, large industrial projects can typically take from six months up to a year or more to gain final approval under the federal Clean Air Act Title V rules for so-called “major sources” of air pollution, which is an industrial facility that emits or has the potential to annually emit 100 tons of any air pollutant, 10 tons of any hazardous air pollutant or 25 tons of a combination of hazardous pollutants.

ADEQ and state Economic Development Commission officials said they had expected Sun Paper to be further along in the application process, given the aggressive early 2017 construction timetable the Chinese paper goods giant had set in April when the project was announced at the State Capitol.

PERMIT HISTORY WITH OTHER BIG PROJECTS

According to the ADEQ air permit database, it took Big River Steel nearly eight months before it received approval for its initial five-year Title V air permit because of challenges in the process from rival steelmaker Nucor Corp. That challenge held up the groundbreaking ceremony for that northeast Arkansas superproject for about six months.

For two other multimillion biomass projects that also plan to profit off of the same ample timberland sources in South Arkansas’ as Sun Paper, the Title V approval from state environmental officials was vastly different.

For example, it took Zilkha Biomass of Monticello less than six months to gain Title V approval from ADEQ. But even with that quick approval of the company’s five-year permit to start construction on its $90 million proprietary black wood pellet manufacturing plant in Monticello, company officials said in June that construction on the project has been slowed due to delays in obtaining long-term contract commitments.

On the other, Highland Pellets of Pine Bluff expects to complete construction on its $200 million pellet manufacturing facility even though it took the company exactly a year to gain Title V approval. Highland Chairman Tom Reilley said the project, backed by a privately-financed investor group, is expected to begin production in late 2016.

Zilkha’s current air permit for its south Arkansas pellet mill was issued July 2, 2015 and expires on July 1, 2020. Highland’s active five-year air permit for the company’s Pine Bluff sawmill expires on Sept. 14, 2020.

And although it does not plan to compete with Zilkha and Highland in the wood pellet market, Sun Paper’s will still need to gain Title V approval from state environmental officials to run its much larger, bio-products mill in Clark County.

Once fully operational, all three timber companies will be located at the epicenter of south Arkansas’ vast timber stock, each mill less than 90 minutes away from each other.

Mullinix said the Sun Paper mill, however, is unlike any other on the continent.

“We are excited about this project coming to Arkansas, and it will be the most technologically advance mill of its kind in North American and a catalyst for other manufacturers looking for an (engineering) design that is very friendly to the environment,” she said. “When you look historically at this industry, that is not what you expect to see.”