Millennials are reshaping the banking world, more responsible than their parents

by May 11, 2016 9:55 am 511 views

Forget the notion that Millennials are still living in their parents’ basements. A vast number of the 83.1 million people born between 1982 and 2000 are working professionals, and the majority see banking relations as an important part of their financial future.

But they are not like their parents and grandparents and status quo services will not be enough to woo their business, according to industry research.

“It’s mandatory that banks reach out to Millennial customers and that the services they provide both in physical and digital formats be top notch in terms of experience, convenience and ease of use,” said Mike Sells, CEO of the Sells Agency in Little Rock.

Research conducted by the Sells Agency in 2014 found that 77% of this millennial cohort earning at least $25,000 annually have a savings account, are already socking away funds for retirement and they’re using credit more responsibly than their parents – all of which is good news for banks. He said these digital natives likely prefer mobile banking options to online and in-branch, but research shows they use all three.

Sells said 82% of the young professionals in the survey said the number of branches a bank has is important to them because they want convenience, even though the majority of them (56%) said they went into a bank branch less than once a month. Roughly a third said they used bank branches from one to a few times monthly, and 11% never use a branch.

FINANCIAL ACUMEN

While the majority of banking activity, deposits, withdrawals and bill paying are done online or through mobile banking options, he said Millennials use bank branches as resources for professional advice and services such as retirement planning or budgeting for a home purchase.

“This demographic has the financial acumen that their parents’ often lacked,” Sells said. “They do value a bank branch as a place where they get professional advice and they are using branches for this purpose. This has banks reconsidering what they do with their branches in the future. For instance, Regions Bank’s recent ad campaign doesn’t focus on product, but it spotlights advisory services from budgeting to starting a business with personal stories shared with viewers. This personalization of services and experiences play right into the hands of Millennials.”

“We have found that many of our Millennial customers have fond memories of coming to the bank as children, whether it was getting a lollipop as they went through the drive-thru or some other story. The old notion that bank branches will eventually become extinct isn’t what we are seeing today as this group of consumers have told us that nothing takes the place of having someone to talk to for advice on financial matters,” said Donna Kimes, senior vice president of Farmers & Merchants Bank of Stuttgart, parent company of the Bank of Fayetteville.

Jim Cargill, president and sales manager for Arvest Bank’s central region, said there is also an expectation of simplicity from Millennial customers.

“They want their products and services to work well, be easy to use and they expect it to be easy to find help if needed. Millennials are also very resourceful when it comes to technology. They need less instruction and support than other age groups and tend to ‘figure it out’ for themselves by experimenting or playing with a mobile app or a website,” Cargill said. “We’ve also seen that while their preferences and methods of doing things may be different, they are ultimately like most customers – they expect value, fair pricing and great personal service.”

Scott Brady, marketing senior vice-president with First Security Bank, said his outfit took a different path to pursue Millennials.

“This generation has come of age in an era searching, skipping, sharing, and deleting the media they ‘choose’ to consume, so capturing their attention via traditional media is not really achievable, unless the content is delivered ‘live’ via reality TV or sports,” he said. “We began focusing our efforts on new media channels over three years ago in order to appeal to a wider, and younger audience, and we’re not only sharing content on our own OnlyInArk.com website, but creating and publishing original content as well.”

USE OF CREDIT

Millennials are the most educated among all the age demographics today, but that higher education comes at a cost as the average Millennial consumer in Arkansas owed $25,433 in student loans as of 2014, according to CollegeInSight. Bankrate.com research found that Millennials are not averse to using credit, but they are doing so more wisely than previous generations.

Millennials “grew up in a world where the economy was tanking,” said David Pommerehn, senior counsel with the Consumer Bankers Association and contributor atBankrate.com. ”There was great concern about jobs and debts and paying off bills.”

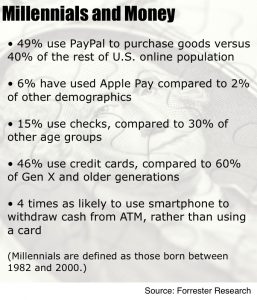

As the economy is improving, Millennials are using credit more so than in the past. In 2014, Bankrate.com found 63% of Millennials between the ages of 18 and 29 didn’t have a credit card, compared to 35% of adults 30 and older. The study also found that just 6% of Millennials had two credit cards, but nearly all of them use debit cards tied to checking accounts and have quickly adopted mobile payment options.

A 2015 report from Mercator Advisory Group suggests that this credit freeze is now beginning to thaw as 57% of Millennials were using credit cards, up from 48% in 2013. Karen Augustine of the Mercator Advisory Group said credit card issuers are doing a better job of introducing new credit card products that appeal to Millennials with tools such as budgeting guidelines that help young consumers spend more responsibly.

Credit experts at Bankrate.com said with up to 18% of Millennials’ net income going to pay student loans this cohort’s limited use of credit cards could make it harder for them to make home purchases in the future because they will have thinner credit history results, which makes having established banking relationships even more essential for this consumer demographic.

Kimes said tighter regulation on how credit card companies could recruit new customers on college campuses in recent years has helped reduce credit card usage among young adults. She said the days of high school graduates getting $2,000 credit lines before they had a dime of income are over, thanks to tighter regulations.

“This was bound to have helped curb credit card usage among some Millennials, simply because they didn’t have as much access to credit cards,” Kimes added.

Cargill said Millennials want to be financially responsible and they want to understand all of their options before making a decision on a financial product.

“Our research is showing that Millennials intend to save more and are indeed starting to save sooner than previous generations. This is partially shaped by their experience during the Great Recession and seeing how older friends and relatives who were not prepared with adequate savings were adversely affected,” he said.

CARETAKER IMAGE

Trust and personal service are two important factors Millennials use to evaluate banks, according to analysts with CCG Catalyst research firm. “They want the institution to act as an “overall financial caretaker” for them, said Paul Schaus, CEO of CCG Catalyst. “Millennials set a high bar and they want their banks to advise them on financial matters.”

He said while technology is also essential to Millennials, it would be a mistake to think they don’t care about human connections with their banker. The challenge is being able to balance the two, Schaus said. Millennials still very much rely on the personal touch of banking, but will judge a bank on the basis of its digital capabilities.

Banking experts agree that Millennials are not typically scouring the Internet to find the coolest free checking account, but they are looking for things that they identify with, such as service perks and convenient access. The Center for Generational Kinetics and Global Cash Card reports that “Millennials don’t want a bank. They want an experience.”

“This generation is looking for help running their lives, not just their finances. We want an interactive experience to learn about investing. We want step-by-step instructions on paying back our student loans. We want virtual advisers to guide us through making big purchases,” according to Gabrielle Jackson Bosche, a Millennial strategist and author of “5 Millennial Myths: The Handbook for Managing and Motivating Millennials.”

“Simply offering mobile banking today is cost of entry and in order to compete our mobile offering must be feature-rich and have an appealing and efficient user interface. Even though technology is the development focus in the banking industry today, we believe there is still value in the ability to speak to a real person, either on the phone or face-to-face, which we will always be able to deliver,” said Brady.

DIGITAL MUSTS

Cargill said Arvest is working with Millennials by acknowledging what they want and then providing the solutions. He said banks are continuing to evolve more new technology services while also still keeping the standard services used by older generations. Mobile banking is used more by Millennials, which is why Arvest will continue to invest in user-friendly mobile apps as well as offer a rewards program on debit cards as Millennials have a strong preference for a convenient ATM network and they also appreciate loyalty rewards.

The most recent J.D. Power Retail Banking Satisfaction survey found that large banks had a higher satisfaction rating than community banks and credit unions for the first time ever. Jim Marous, co-publisher of The Financial Brand, attributes the turnaround of the once-hated “big banks” to higher satisfaction levels with digital banking service offerings.

The newest trend in the banking sector is cardless cash where consumers use their smartphone instead of a debit card to get cash from an ATM. The technology has been offered in larger metro areas like Los Angeles for at least two years, and Bank of America, Wells Fargo and JPMorgan have announced plans to roll out cardless ATMs in the coming months.

Kimes doesn’t expect to soon see cardless ATMs in Arkansas, but she did reference a growing trend in peer-to-peer lending that uses a mobile phone to transfer money from one person to another with services like Pop Money or Venmo, which is a payment transfer system app that uses PayPal.

“We are finding more digital consumers are using Popmoney (www.popmoney.com) transfers which are available at many banks, even in rural towns like Stuttgart. Say we go to lunch and decide to split the bill but you don’t have any cash. I pay the bill and then you can send me a payment via a text message which is linked through the app to your bank account. Then I get a text when payment has been sent directly to my bank account. It can also work for someone trying to collect money. They send out a request for payment through a text, the one owing money simply responds ‘Pay,’ and the money is transferred,” Kimes said.

From Apple Pay to various other mobile payment systems already in use, Kimes predicts payment options will continue to expand. She said the days of having just a few payment providers are over, as there will continue to be more payment processors cutting up the pie into smaller pieces.