Northwest Arkansas tourism and travel sector ends 2015 with record results

by February 22, 2016 6:04 pm 576 views

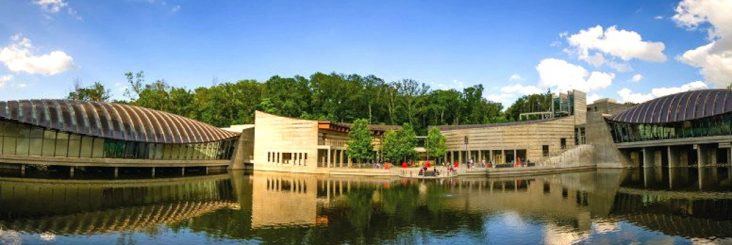

Crystal Bridges Museum of American Art drew 608,000 visitors through its doors in 2015, 100,000 more than the annual average since opening in 2011. The Bentonville-based museum helped boost Northwest Arkansas hospitality tax collections more than 14% in 2015.

The four largest cities of Northwest Arkansas cumulatively reported total hospitality tax revenue of $6.458 million for 2015, up 14.2% from the $5.654 million reported in 2014. Bentonville, Fayetteville, Springdale and Rogers each posted double-digit revenue gains in 2015 from 2014.

The local tourism sector continued to blossom throughout 2015 with the Amazeum opening in July, improved business travel amid a stronger overall economy and plenty of recreational traffic thanks to the opening of the Razorback Greenway kicking off its completion and grand opening in May. The Frank Lloyd Wright Bachman/Wilson House opened on the campus of Crystal Bridges in November, which is expected to draws thousands of annual visitors.

Crystal Bridges Museum of American Art drew 608,000 visitors through its doors in 2015, 100,000 more than the annual average since opening in 2011. In September last year the museum welcomed its 2 millionth guest, a milestone accomplished in just 21 months. Museum officials said in October that a majority of patrons come from within a day’s drive, but they now see more visitors from the east and west coasts. The city reported $2.14 million in hospitality tax revenue in 2015, up 17.5% compared to $1.82 million in 2014. (Bentonville collects a 2% tax on hotel and meeting space and a 1% tax on prepared foods.)

Fayetteville hotel and restaurant tax collections totaled $3.066 million in 2015, up 12.8% compared to the $2.717 million in 2014. (Fayetteville is the only city among the four to collect a 2% tax on prepared foods in addition to the local hotel /motel tax.)

“Fayetteville is clearly on the map as a regional and national destination for families,

artists, cyclists and tourists with a variety of other interests,” said Kym Hughes, executive director for the Fayetteville Advertising and Promotions Commission. “Fayetteville was a hot spot for sporting events, tour groups, business meetings and conventions in 2015, all of which grew in numbers from 2014.”

The largest boom in regional interest stemmed from the Dallas/Ft. Worth area that showed a 139% increase in visits to the commission’s website last year, according to Hughes.

Rogers and Springdale each collect a 2% tax on hotel and meeting space and do not impose a prepared food tax. Rogers, the larger hotel district of the two, reported annual hospitality taxes of $825,679 for the full year of 2015, up 11.3% over the $741,661 reported a year ago.

Springdale hospitality taxes totaled $425,904, also a record for that city, and up 13.49% over the $376,156 report in 2014.

A report from STR Global indicates that the hotels and motels across Northwest Arkansas enjoyed improved occupancy levels and higher average daily room rates in 2015 compared to prior years.

In 2015 this local sector saw average occupancies of 64.2%, compared to 59.4% and 54.3% in the two prior years, respectively. Supply continues to outpace demand on a per-night basis which keeps the average occupancy levels higher than optimal during some months of the year. Local hotel managers say as occupancy levels have continued to improve, room rate discounts have come down. That is reflected in the $84.29 average room rate for the 2015 year, above the $80.79 in 2014. Since 2012 average daily room rates have risen 11.5% while occupancy levels have increased 22%, according to the STR report.

Total hotel revenue reported for the region by the STR report rose to $159.755 million in 2015, up from $139.217 million reported by STR in 2014.

STRONG FOURTH QUARTER

Bentonville, Fayetteville, Rogers and Springdale reported combined hospitality tax revenue of $1.659 million in the fourth quarter of 2015, up 9.79% from $1.511 million reported in the same three-months of 2014. Fayetteville and Rogers reported double-digit growth from a year ago.

Fayetteville, the largest city in the region when including the student population at the University of Arkansas, posted the biggest fourth quarter gains. In Fayetteville, total taxes collected by the city’s Advertising and Promotions Commission rose to $807,504 for the fourth quarter of 2015, up 10.39% over the $731,496 reported in the fourth quarter of 2014.

Restaurant growth across the city was responsible for the bulk of the year-over-year tax revenue increase. Restaurants collected $718,507 in prepared food taxes for the quarter rising 11.6% from the prior-year period. Hotels brought in $88,996 in the last three months of 2015, up slightly from the $88,106 reported in 2014 period.

Bentonville hospitality taxes for the fourth quarter totaled $539,547, up 9.9% from the $481,660 collected in the same quarter of 2015. Each month in the quarter, hospitality taxes collected by hotels and restaurants increased from the year-ago period. Restaurants pulled in $350,684 in the quarter, rising 8.41% from a year ago.

Bentonville motels rang up $178,863 in hospitality taxes for the quarter, up 13% from the $158,190 reported a year ago. During 2015 the city added 100 new rooms with the opening of the Sheraton Four Point facility in the spring.

In the fourth quarter Springdale hotels turned in tax receipts totaling $117,201, a 2.8% improvement over the $113,996 reported a year earlier. While the fourth quarter is typically not one that garners the highest business or recreational travelers, Springdale has managed to grow its fourth quarter hotel tax receipts by 14.71% over the past two years. Since 2011, the year the city raised its hotel tax to 2% from 1.5%, hotel tax revenue generated in Springdale has risen 34.5%.

Roger Davis, general manager of the Holiday Inn and Convention Center in Springdale, attributed the increase in revenue to steady improvements in traffic from business travelers since 2011 and said in more recent years a stronger economy has helped to ratchet up overall travel which has benefited the entire tourism sector.

Like Springdale, Rogers does not collect a prepared food tax but it does contain the region’s largest meeting spaces and the majority of hotels used by corporate business travelers using Northwest Regional Airport. Rogers posted hospitality tax revenue of $205,600 in the fourth quarter, an increase of 11.7% from the same period in 2014. In the past two years hospitality taxes are up 31% in Rogers and up 52% since the same period in 2010.

While the hotels in Benton County typically see a larger percentage of business travelers, there has been more regional visitors driving to the area for overnight stays than in recent years. Northwest Arkansas Regional Airport (XNA) enplanements were lower in the fourth quarter compared to the same period in 2014. Enplanements from Oct. 1 through Dec. 31 totaled 155,992, which was down from 156,503 in the same period of 2014.

Experts say lower gasoline prices and higher fares flying out of XNA likely have more business and leisure travelers using other airports and driving into the region when possible.

HOSPITALITY TAXES (January – December)

Bentonville

2015: $2.14 million

2014: $1.82 million

17.6%

Fayetteville

2015: $3.066 million

2014: $2.717 million

12.8%

Rogers

2015: $825,679

2014: $741,661

11.3%

Springdale

2015: $426,904

2014: $376,156

13.4%