Sam’s Club top execs under pressure to boost holiday sales, improve traffic

by November 5, 2015 8:00 pm 484 views

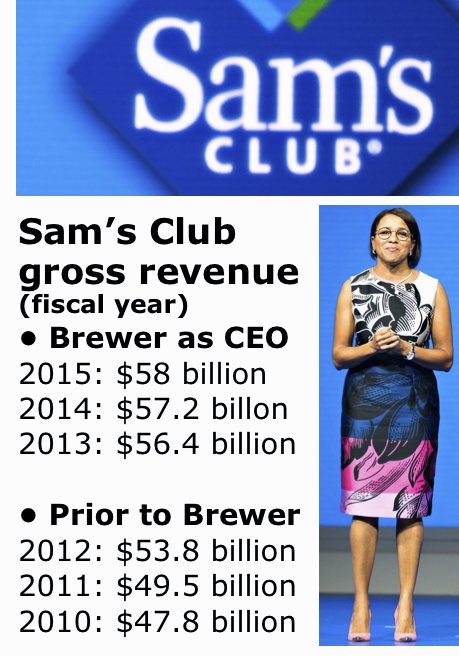

Sam's Club CEO Rosalind Brewer

Analysts and retail insiders say this holiday season could make it or break it for Sam’s Club top management, which has already seen major changes in recent months, to include a new merchandising team shift led by John Furner who was brought back from China to try and energize this laggard division.

That news came on the heels of Sam’s Club CEO Rosalind Brewer’s announcement Oct. 2 of a new strategy change with nine top level organizational moves.

It’s no secret Sam’s Club has fallen from grace. Just a few year’s ago Carol Spieckerman, CEO of Speickerman Retail, described the Sam’s Club division as the “shining star in Wal-Mart’s portfolio.” That was the case when Brewer took over as CEO in early 2012. But quarter after quarter since, Sam’s Club has struggled with top line sales growth and somewhat anemic same-store growth compared to competitor Costco.

Despite a stronger economy, the first half of fiscal 2016 hasn’t been fruitful for Sam’s Club as net sales dipped 1.88% from the same period last year. The difference amounted to more than $541 million in fewer sales. The division also posted lower operating income down 12% or $118 million compared to the year-ago period.

Comparable-store sales for the six-month period have been negative, largely because of declining fuel prices. Through the first half of this year Sam’s Club reported comp sales were down 3.2% including fuel and flat at 0.70% without the fuel impact.

STRATEGIES GALORE

Under Brewer’s three and half years of leadership at Sam’s Club her team has continued to try strategy upon strategy to turn the retailer’s performance upward.

In 2012 and 2013, Brewer blamed lackluster performance on struggling small business customers, namely small convenience stores and their reduced tobacco sales as well as mom-and-pop restaurants which were among some of the slowest sectors to bounce back following the recession.

At that point Sam’s Club introduced Small Business Bootcamps and financial lending services to the struggling sector. Last year Sam’s announced for small business members an insurance program with Aetna and access to legal services through LegalZoom and payroll assistance through Execupay.

Brewer and her team also began to focus on expanding membership beyond the small business sector. They raised membership fees and worked to add services to boost the value-proposition of the membership cost such as free subscriptions to five chronic health conditions, and True Car estimates for purchasing new or used vehicles. They also began giving Cash Rewards to help drive the higher priced memberships which appeared to be working through the first half of this year.

A focus on fresh foods and expanding organic offerings was also part of the retailer’s strategy in past years, moves analysts like Budd Bugatch of Raymond James have applauded. Despite some good moves, Bugatch noted earlier this year that Sam’s Club performance has been “frustrating.”

“We hope that management’s focus on merchandise assortment, marketing, member rewards, and e-commerce investment will drive future traffic and ticket improvement,” he said.

Earlier this year Sam’s Club added a chief member officer to help oversee data scientists and marketing professionals with the goal of driving membership growth and improving customer engagement. Analysts said they will look for improvement through the holiday season.

“I do think that the number of initiatives that Sam’s Club has introduced may have caused confusion for its customers which can compromise awareness for its programs and subsequent member adoption,” Spieckerman said. “Sam’s Club needs to bring a simple and compelling value proposition this holiday while ensuring that its convenience options (online ordering, in-store pick up, drive-up collection, etc.) are buttoned up.”

Sara Altukhaim, a retail analyst with Kanter Retail Consulting, likes many of the strategies under Brewer’s leadership, especially looking for a more targeted approach to members instead of trying to be everything to everyone. She said there remains a huge white space in the wholesale club market for a retailer to step up and lead in digital and this is a big opportunity Sam’s can capitalize on given its resources through WalmartLabs.

“These are important and smart directions for Sam’s to be heading in. The concern is less about whether these are the right strategies for Sam’s, and more about how Sam’s can execute them internally while the entire organization aligned, from top to bottom,” Altukhaim said.

HOLIDAY EXPECTATIONS

Murmurings of topdown pressure on Brewer to turn profits upward continue to swirl. Altukhaim doesn’t think it’s in Sam’s best interest to have more upheaval in leadership. But she did note that Brewer’s time at Sam’s is not far from the typical tenure of a CEO there.

“The holidays pose added pressure for the management of most businesses, Sam’s Club being no exception. As the person at the top that is held most accountable, I think there will be some obvious pressure on Brewer to guide Sam’s successfully through the season,” Altukhaim told Talk Business & Politics.

She said consumer spending is up, gas prices are down, and there are plenty of signs pointing to optimism for the holidays this season.

“There’s no reason why Sam’s Club shouldn’t be able to leverage this opportunity to boost growth and it will certainly be important for them to do so,” Altukhaim said.

Earlier this week Sam’s Club management shared its plans for the holiday with the media. Like many other retailers Sam’s Club is hoping to draw shoppers in early, well ahead of Black Friday. Members may begin their Thanksgiving prep and gift shopping early at the one-day only “Lowest price of the season” event. Starting in clubs at 7 a.m. on Nov. 14. Sam’s Club will provide free coffee and breakfast treats to members who shop during this early event.

Sam’s Club plans to feature deals on Apple smartphones and tablets, Visio 65” 4K Smart TVs, drones, diamonds, cookware and toys. However, Wal-Mart is offering many of the same or similar technology products and those low prices began Nov. 1. But Sam’s Club does offer higher-end jewelry, apparel and other items not found in Wal-Mart.

“We’re excited to kick off holiday shopping for our members with our lowest prices of the season event. Our shoppers can feel confident they are getting a great deal on,” Brewer said in the pre-holiday release. “In addition to several savings events, every week, Sam’s Club is rotating new items onto its shelves to help shoppers surprise and delight everyone on their lists. This year we are confident we’re giving our members new ways to save and discover the value of being a member.”

Like Wal-Mart, Sam’s Club is focusing on deals exclusively for online shoppers. The online deals will begin just at 12:01 a.m., on Nov. 14. Unlike Walmart.com, most items ship free within the continental U.S.

Aside from the one-day lowest price event, Sam’s Club will have one more pre-Black Friday event Nov. 21 through Nov. 25 where the retailer will feature Thanksgiving meal essentials and other deals on branded merchandise. Sam’s Club is closed on Thanksgiving Day, but will reopen at 12:01 a.m., Nov. 27 for its Black Friday specials.

“Holiday performance tends to be a contextual proposition. It will be important for Sam’s to perform on par, or slightly better than, its competitors or get thrown into the underperform category,” Spieckerman said. “Sam’s has a real opportunity to strut its stuff this holiday and if successful, tee up a brighter 2016.”