Most Arkansas Stocks Post Share Price Declines Through June 2015

by July 1, 2015 9:15 am 133 views

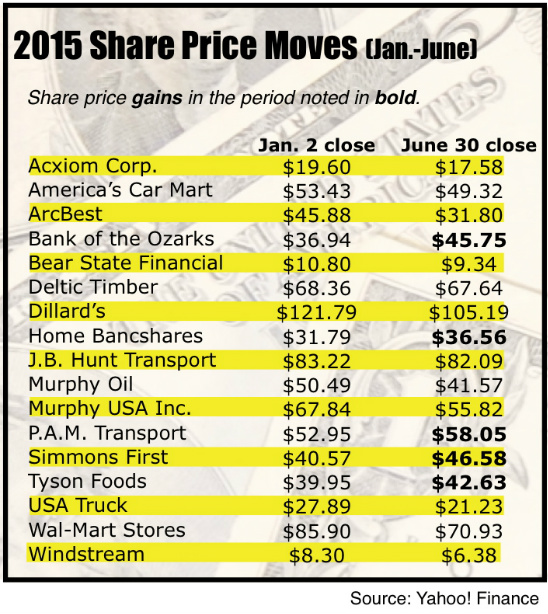

It’s been a tough six months for most of the publicly held companies based in Arkansas, with just five of the 17 tracked by The City Wire showing a share price gain from Jan. 1 to June 30. The story was the same for large market indices.

The Dow Jones Industrial Average stood at 17,619.51 at the market close June 30, down 1.2% from the 17,832.99 close on Jan. 2. The industrials slid 156 points during the quarter from the 17,776.12 reading on Mar. 31, a quarterly decline of 0.88%.

The leading Dow Jones stock for the past two quarters was Walt Disney (21.18%) and Wal-Mart Stores (-17.42%) was the greatest decliner.

The broader index S&P 500 index fared slightly better closing the first half of 2015 at 2,063.11, a fractional gain of 0.24% over the Jan. 2 close at 2,058.20. This is the smallest half-year gain on record going back to 1928. The S&P 500 index slid 0.23% during the second quarter from the 2,067.89 reading recorded March 31.

The NASDAQ had the best performance, up 5.3% for the year so far and up 1.75% for the second quarter.

Analysts have said the imminent default by Greece on its $1.7 billion payment due to the International Monetary Fund at midnight Tuesday (June 30) has weighed heavily on Wall Street in recent weeks.

LENDERS LEAD

That said, CNBC reports the banking sector rose 7.7% in the first half of this year, second only to health care’s advance of 8.4%.

Among the Arkansas stocks, the financials also were the biggest winners led by Bank of the Ozarks. Little Rock-based Bank of the Ozarks had the largest share gains this year, up 23.84% January through June. Pine Bluff-based Simmons First and Conway-based Home Bancshares also gained traction in the first half of this year, each up 15% between Jan. 2 and June 30. Harrison-based Bear State Financial broke that trend, falling 8.88% in the first half of 2015.

The Arkansas banks continue to expand their footprints outside the Natural State with key acquisitions in the past year. Analysts approve of a growth strategy based on diversification of assets.

Bentonville-based America’s Car-Mart is a hybrid used auto dealer/finance company and aligns best with the financial sector. Car-Mart’s stock is down 7.69% in the first half of 2015. Car-Mart management said it was pleased with company’s financial balance sheet and steady growth this year despite the lagging response from Wall Street. The small-cap company has had a volatile ride over the past 52 weeks ranging in price from $35.68 to $57.55.

BUILDING BLOCKS

The national construction sector rose 7.7% in the first half of this year led by improving housing numbers. El Dorado-based Deltic Timber is a supplier of lumber to multiple industries including housing and construction.

For the first half of 2015, Deltic Timber’s stock price fell 1.32% to $67.64 as of June 30. The company’s shares began the year at $68.36. Over the past 52 weeks, the share price has ranged from $58.05 to $70.29. The one-year target price estimate for Deltic Timber shares is $68, according to Yahoo! Finance.

RETAIL WOES

The broad national retail sector rose just 2.5% in the first six months of 2015. One analyst referred to the segment as “schizophrenic,” noting that for every winner there is an equal loser.

Little Rock-based Dillard’s and Bentonville-based Wal-Mart have each had a rough first half, losing share value of 13.63% and 17.42%, respectively, between Jan. 2 and June 30.

Between the first quarter ended on March 31, and June 30, Wal-Mart shares are down 8.9%.

Over the past 52 weeks, Wal-Mart shares have traded as high as $90.97 and as low as $70.78. Recent share pressures on the stock stem from a cautious earnings outlook for the back half of this year amid heavy investments in wage increases for hourly workers and e-commerce infrastructure build out.

Little-Rock-based Dillard’s shares are trading lower on the heels of lower than expected earnings and declining comp store sales. Shares closed June 30 at $105.19, down from $136.51 at the close of the first quarter. The company’s guidance for fiscal 2015 indicates significant cost pressures for the year, which might hurt the bottom line in the back half of the year.

TRUCKING MIX

The transportation sector on the whole was a laggard, losing more 11% in the first two quarters of 2015. Among Arkansas trucking lines, the performance for the first half of 2015 has more losers than winners.

Tontitown-based P.A.M. Transportation Services Inc., was the clear winner as its share price grew 9.63% through the first six months of the year. Shares closed June 30 at $58.05, which was a slight increase from the $57.27 price to end the first quarter.

P.A.M. management continues to aggressively repurchase its shares which is helping support the stock price. The company announced this week that it’s increasing the purchase offer from up to 80,000 shares, or about 1.1%, of its outstanding common stock, to up to 150,000 shares, or about 2% of its outstanding common stock.

Lowell-based J.B. Hunt Transport was one of the losers but shares are down just 1.32% since Jan. 2. Shares closed the second quarter at $82.09, which was down 3.91% from the $85.40 closing price end to the first quarter.

RBC Capital analyst John Barnes upgraded the rating on J.B. Hunt on June 10 from sector “perform” to “outperform,” while raising the price target from $92 to $105. He expects the company to post better results in all of its four divisions in the back half of the year.

With the trucking industry facing a capacity crunch within a competitive sector, Barnes also expects continued modal conversions to rail. In addition, with rates expected to rise in the intermodal market, J.B. Hunt should see meaningful margin growth in its intermodal division.

“Furthermore, we believe that the company’s dedicated division is poised to see more robust growth as truck capacity tightens and shippers again become more focused on procuring consistent capacity,” Barnes stated, while adding that he expected to see “steady growth in both the brokerage and TL (truckload) divisions.”

Van Buren-based USA Truck and Fort Smith-based ArcBest (formerly Arkansas Best Corp.) turned in double-digit declines through the first two quarters of 2015.

USA Truck shares closed June 30 at $21.23, down 23.87% from the closing price of Jan. 2. The stock price fell more than 23.33% from the closing price of $27.69 on Mar. 31. The majority of the negative move on the stock came after the announcement that CEO John Simone took a medical leave of absence on May 7 related to strokes that have affected his speech.

ArcBest took the bottom spot among Arkansas trucking companies for the first half of 2015. The shares closed the first half of 2015 at $31.80, a loss of 30.69% from the start of the year. Between the first quarter close of $37.89, and June 30, the shares lost 16% of its value.

Analysts with Zacks noted earlier this month that the slump shouldn’t be a surprise to investors, as this transportation company has seen eight negative revisions in the past few weeks and its current year earnings consensus has moved lower over the last 30 days. There could be more trouble down the road. Merrill Lynch Bank of America analysts downgraded ArcBest shares to underperform on May 29.

OIL LOSSES

It’s no surprise that oil related stocks have reported lower share performance this year amid the lowest commodity oil prices in recent decades. El Dorado-based Murphy Oil and Murphy USA are down 17.66% and 17.72%, respectively, in the first half of 2015.

Murphy Oil closed out the first half of 2015 at $41.57, which was also lower than the $46.60 recorded at the end of the first quarter.

The volatility for oil exploration and production companies like Murphy Oil have been the most affected, as their fortunes are tied to commodity price fluctuation. Oil prices seem to have stabilized over the past two months after sinking to a 6-year low of under $44 earlier this year. The commodity has largely been range bound in the $50-$60 level since early April – a price OPEC considers ‘fair’ for their crude

Murphy USA, the gas station operator, closed the first half of the year at $55.82, down more than 17% since Jan. 2. Between the first quarter and end of the second quarter, Murphy USA share values declined 22%.

TECHNOLOGY LAGGARDS

The national technology sector has fared well this year rising 18% in the first six months of the year, led in part by Apple up more than 13% year to date. Two Arkansas-based tech companies were among the losers in the giant and diverse sector. Little Rock-based Acxiom closed the first six months at $17.58, a loss of 11.49% in share value since the year began Jan. 2.

Acxiom shares slid backward between the first and second quarter final trading days. Shares stood at $18.49 on March 31, falling 4.92% through the second quarter which ended June. 30.

Windstream also tumbled. The Little-Rock-based telecom company closed out the first half of 2015 with a share price of $6.38, down 23.13% from $8.30 where the company’s shares closed on Jan. 2.