Wal-Mart eases credit card terms in hopes of gaining more users

by May 11, 2017 7:41 pm 2,466 views

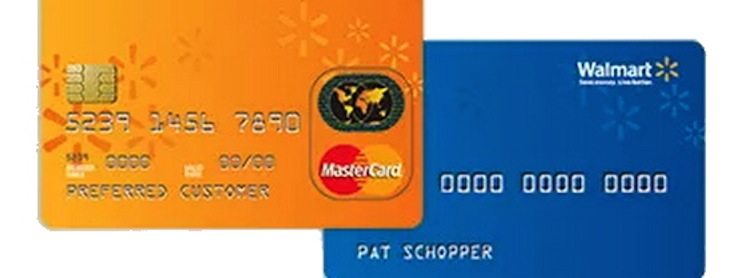

Retail giant Wal-Mart Stores is wooing shoppers into the fold as it tweaks the terms on its store credit card and the Walmart Mastercard.

Wal-Mart this week said it simplified the financing terms relating to promotional periods. In the past special financing such as 0% for 90 days or six months meant interest accrued during that time. As long as customers paid off the balance during the promotional time they paid no interest. But if it took them longer, they were hit with the interest that had been accruing through the promotional period.

“The reality is most people’s lives are anything but predictable, and paying off a purchase within a set period of time doesn’t always happen as planned. We have responsibilities that weigh on us – tasks and relationships to juggle and, of course, a never-ending stack of bills to pay,” said Daniel Eckert, senior VP of services for Walmart U.S.

Eckert blogged this week that Wal-Mart saw an opportunity to help customers by simplifying the special financing offer on the Walmart Credit Card and the Walmart Mastercard Credit Card.

“With the new offer, you can now take advantage of no-interest financing for purchases, meaning that absolutely no interest accrues during the six- or 12-month promotional period. It’s really that simple and straightforward,” he said.

Wal-Mart explained the special offer on Walmart’s store card and Mastercard includes six months zero interest for purchases made in store between $150 and $298.99. For purchases of $299 or more the zero interest period is 12 months.

The Walmart store card is a good deal for consumers with fair credit, said Beverly Harzog, consumer credit expert and best-selling author of The Debt Escape Plan. She said the 23.4% annual percentage rate on the card indicates the target audience is shoppers with less-than-stellar credit.

Harzog said consumers need to read the fine print when they shop for credit cards. The other perks offered with the Walmart card is 2% savings on fuel purchases at its gas stations as well as Murphy USA. There is also a 3% savings on items purchased at Walmart.com and 1% savings on items bought at Walmart. Through June 14 Wal-Mart said it will give a 20% savings up to $50 on the first item purchased by new cardholders. The maximum late fee is $37 and there is a 23-day grace period.

WalletHub gives the Walmart store card a 3 star rating out of 5. The Walmart Mastercard has an APR between 17.4% and 23.4% with the same perks and fees as the Walmart store card. The Mastercard is rated 3.5 stars by WalletHub.

Amazon recently unveiled its rewards signature card which give 3% cash back on items purchased at Amazon. It also gives 2% on restaurant purchases and at drug stores.

Harzog said for consumers with fair credit the QuicksilverOne card by Capital One offers 1% cashback on every purchase with an APR of 24.99%. The key for anyone with a high interest card is to pay off the balance each month.

“Unless consumers can payoff the balance each month, they do need to use a credit card. At the high 24% APR the compound rates can be a recipe for debt,” she added.

Harzog said the Chase Freedom card gives 5% cash back up to $1,500 per quarter is one of the best cards for those with good credit. She said this card along with Discover It, rotate the places where the 5% cash back is optimized each quarter and often include ways for consumers to use to cards to pay for everyday expenses such as local transit costs.

Harzog said consumers should avoid taking cash advances on the cards where they are allowed. She said the interest starts accruing instantly on the full amount of the cash taken with no grace period and regardless of 0% promotional periods.