Tyson shareholders approve of stock performance, still seek more transparency

by February 5, 2016 1:16 pm 237 views

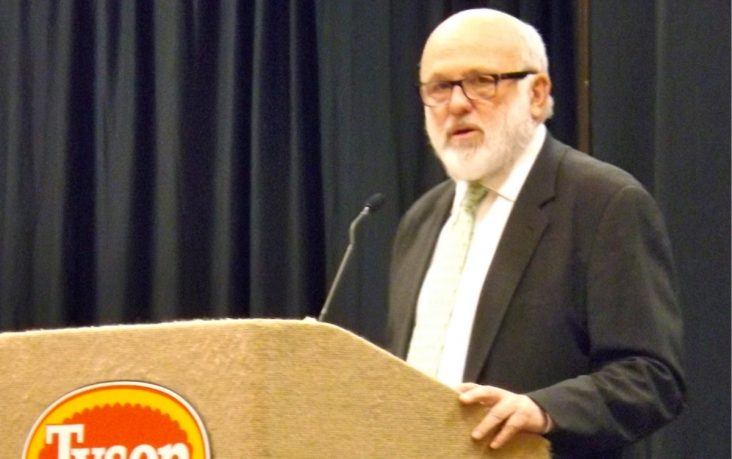

John Tyson, board chairman of Springdale-based Tyson Foods, speaks Friday (Feb. 5) during the company's annual meeting.

A sparse crowd of Tyson Foods’ shareholders convened in Springdale Friday morning (Feb. 5) for the company’s 53rd annual shareholder meeting. Little time was taken to celebrate the record year the company had in 2015, nor the bountiful first quarter earnings it reported earlier in the day.

The no-frill meeting was business as usual for the meat giant as six shareholder groups stood up before Board Chairman John Tyson to voice a variety of concerns about the lack of transparency the company provides with lobbying efforts, water quality and sustainability plan, and plant safety records. Groups also asked the Tyson family, who controls the voting rights for the overall company, to consider changing their positions on caging production animals, and consider moving toward an independent board chair.

All six of the shareholder proposals were voted down by an overwhelming majority given that the Tyson family vote did not approve of the proposals. With its dual-stock system, the B shares owned entirely by the Tyson family enjoy a 10-to-1 voting advantage over those holding A shares, which is all of the public shareholders. The overall A shares pool amounted to 294.050 million potential votes, while the family’s B shares (70.010 million) controls more than 700 million votes given its 10:1 advantage.

Proposal #1 asked the board to consider requiring pork farmers to eliminate use of gestation cates in their breeding operations. This proposal garnered only 12.58% of the overall vote with more than 797 million votes against the proposal.

Proposal #2 asked the company to address a sustainable water stewardship plan. The speaker, a Missouri resident, cited the Tyson leak in Monett which killed more than 100,000 fish in that city’s natural waterways. Reverend Charles Scott, representing the Interfaith Baptist Church, said Tyson shareholders would be better served with a stewardship plan in lieu of the present game plan that often includes accidents followed by hefty fines and legal consequences. A second speaker with the Baptist group addressed John Tyson saying that a similar proposal garnered 52% of the voter approval without the Tyson family included.

“I am asking the Tyson family to … consider this proposal because it’s the common sense way to do business,” she said.

John Tyson responded by saying the family is concerned about water quality issues and the proposal response outlined in the proxy filing speaks for itself.

Proposal #2 was soundly defeated with 800 million votes against, while 109.651 million votes were in favor.

Proposal #3 asked for an independent board chairman. This was defeated with 780.58 million votes against, while 145.919 million, or 15.7%, were in favor.

Proposal #4 asked the board to consider moving away from the dual-class stock system that affords the Tyson family total voting control of the company. The proposal was defeated with 719.86 million votes against, while 206.84 million votes approved.

Proposal #5 dealt with providing an annual report on plant safety records to ensure Tyson’s safety record improves. More than 93% of the votes were cast against the measure with just 4.54% approval.

Proposal #6 was brought by the International Brotherhood of Teamsters who want Tyson Foods to provide more transparency into its lobbying efforts. While federal PAC contributions are recorded, the group noted that contributions to trade groups like the American Beef Federation and the National Chicken Council as well as state and local lobbying efforts are not readily available. The proposal failed with 88.7% of the votes being against it. Roughly 9.5% of the voters approved.

Shareholders did unanimously approve the slate of directors for this next year as well as ratification of the Pricewaterhouse Coopers LLC as its accounting firm. Shareholders also approved the renewal of its annual compensation plan with 99.27% approval.

Following the business portion of the meeting Chief Financial Officer Dennis Leatherby gave an update on the company’s financial position. He said with strong cash flow and some $2.4 billion in liquidity the company remains committed to paying down debt to keep its investment grade rating.

“We have set aside funds to retire the $628 million notes coming due in April. Over the past 19 months we have paid down roughly $2.4 billion in debt while also committed to raise our dividend. Our earnings per share year-over-year in 2016 should reflect an 18% growth rate,” Leatherby said.

On a somber note John Tyson took a few minutes to pay tribute to the late Buddy Wray, who was a pioneer in the business managing along Don Tyson, his good friend. John Tyson said he was a mentor to many through the decades and his presence and leadership will be missed.

“We seek to honor him through our actions and service of this company going forward,” Tyson said.